IT affect on Merger Transactions

The Board’s desire to involve the IT role in ‘Acquire, or Not-to-Acquire’ decision-making

Preventing Merger Value Erosion

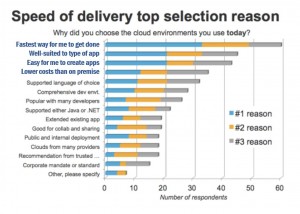

Over past M&A activity, a recent survey report I read stated that nearly 50% of senior executives said that more detailed IT due diligence could have prevented merger value erosion. Only one third of corporate transactions put an emphasis on IT but more worryingly nearly 20% of the survey recognised that dealing with IT had the most challenges post transaction.

The key red flag that came from this report was that during M&A transactions 80% of respondents largely engaged the Finance function followed by Legal then Operations but IT only came forth on the list at 50%.

The changing landscape of the IT Technology arena within corporate Merger or Carve-out

To acquire, or Not-to-acquire – The question most CEOs ask their CFO is:- Will the transaction drive financial rewards and what are the risks, but really the glaring missing player here is the CIO!

Ask yourself, How many CFOs have you come across that have a full and clear understanding of the value an ‘Open and connectable’ versus ‘out-dated and proprietary’ IT department can make in driving business revenue growth.

This means that Board Executives are negotiating in the dark and potentially loosing large percentages of ‘cost-of-acquisition’ value. There couldn’t be a better time for the CEO to bring the CIO to the table.

Businesses today are under more pressure than ever to deliver value to stakeholders, particularly when undertaking bold initiatives such as mergers, acquisitions or asset disposals. This is true not only for corporate acquirers but also for private equity (PE) or Venture Capital (VC) firms, whose strategy is leaning toward add on acquisitions as a means of growing their portfolio companies.

Under the current economic conditions and the rising cost of debt, corporate business management teams will require additional focus on effort in order to restructure or streamline operations, and specifically the IT departments of acquired businesses to deliver success in the absence of financial engineering. For a while now Information Technology (IT) is fast becoming a key lever which management can use to deliver operational benefits — whether in reducing operational costs, entering emerging markets or scaling their business across multiple geographic regions. With the advances in technology and its impact on today’s business models, companies are increasingly pushing the boundaries to remain competitive. IT is one key area to do this — Technology should be looked at as a business enabler and not look at as so many boards still do today, as a cost to do business.

“The sooner that executive boards put the CIO or the IT department on their monthly agenda as a regular discussion point the better,” says Craig Ashmole, Founding Partner of London based CCServe consulting. In my humble experience and far too often I see the CIO struggling to get the ear of the CEO or even agendas on the board table; businesses need to view IT as a business enabler rather than viewed purely as a cost centre.”

Part of the reason the CIO is not at the board table is that often they do not speak the language of the business board executive. Technology scares most senior board members and until the Generation Y and Generation X group get into those senior positions we will continue to see a disparity with Technology and Fiscal business matters.

The CIO challenge is to do his/her bit too, they really need to fully engage with the commercial business functions, and stop hiding behind technology to protect themselves. The ‘head-in-the-sand’ CIO will have a rapidly growing threat from the likes of the CMO or emerging CDO Digital Officer. Understanding the business functions that deliver revenue is a key focus going forward.

With the fluid market of M&A today there are two clear distinct areas a corporate or global business can go with this. One; is to look at how costly it will be to split companies up or carve out elements that are no longer key areas of business growth for that organisation and IT efficiency should be at the forefront, not just fiscal separation.

The other area on the acquiring side of an M&A transaction – Many CEO/CFOs look at the cost of acquisition proposed by the big 5 consultancy houses, often building in huge elements of ‘cost of sale’ to mitigate IT integration risk especially where transaction teams are uncertain.

“Making ones own IT and infrastructure easy to connect with while utilising open standards or cloud services could help the process of bringing together two disparate lines of business,” Craig Ashmole goes on to say, “More importantly M&A is about the shortest time to ‘joined-up’ business revenue growth which gets the attention of the CEO. Well prepared IT and infrastructure are key success elements to that joined-up process.”

There is a large growth of non-accounting technology focused personnel coming into the Big-5 transaction teams as more emphasis is given to IT & Technology within the merger/carve-out transaction process. This however should be balanced, in my opinion, with the use of the CIO office within the business. What an IT department or CIO office may lack however is in the broader wider exposure that seasoned interim independent consultants could bring to the negotiations. Independent interim IT consultants have often engaged in similar situations or have awareness skills from engaging in many other organisations as they move from assignment to assignment.

Whatever the CEO or board choose to do as they grow through acquisition, or transform through business carve-out, they should put the IT agenda firmly on the boardroom table and take advantage of the experience and quick turn-rounds that so many senior and interim consultants have to offer.

Recent Comments