Cloud Comparison Index

The ISG Technology Insights Group Launches the Cloud Comparison Index™

The First Benchmarking Service That Compares Costs of Public Cloud versus Internal IT

Study Shows Usage Matters; Public Cloud Not Always Cheaper

Price Differential Among Public Cloud Providers as High as 35%

STAMFORD, USA ― Information Services Group (ISG), a leading technology insights, market intelligence and advisory services company, has announced the launch of the ISG Cloud Comparison Index™, a new advisory and benchmarking service that offers clients a first-ever view of how public cloud costs differ among providers and how they stack up against those of internal information technology (IT) solutions.

ISG plans to publish in-depth analysis every quarter and make the reports available via subscription to the AccessISG™ on-demand information and consulting service. Future reports will examine the relative costs of using the public cloud versus internal IT for a variety of infrastructure configurations, applications and workloads.

The ISG Cloud Comparison Index™ leverages internal IT cost data from ISG’s proprietary benchmarking database and compares it with the prices of public cloud configurations from the four major public cloud providers: Amazon Web Services, Google Cloud Platform, Microsoft Azure and IBM SoftLayer. The public cloud data is sourced from Gravitant, a global strategic partner of ISG.

“ISG is in a unique position to help clients understand the true cost of moving work to the public cloud, versus performing the work in-house,” said Todd Lavieri, president of ISG Americas and Pacific. “The ISG Cloud Comparison Index™ combines our market-leading IT cost data with public cloud pricing data from Gravitant – creating an incredibly powerful analytical platform that delivers new insights into the relative benefits of harnessing Infrastructure-as-a-Service (IaaS) offerings versus leveraging fixed-cost, on-premises IT assets. This unique combination of data sets offers CIOs and other IT leaders a solid basis for sound decision-making, along with an objective view of the complex and rapidly evolving market for cloud-enabled services.”

First Report Shows Usage Matters in Public Cloud Pricing

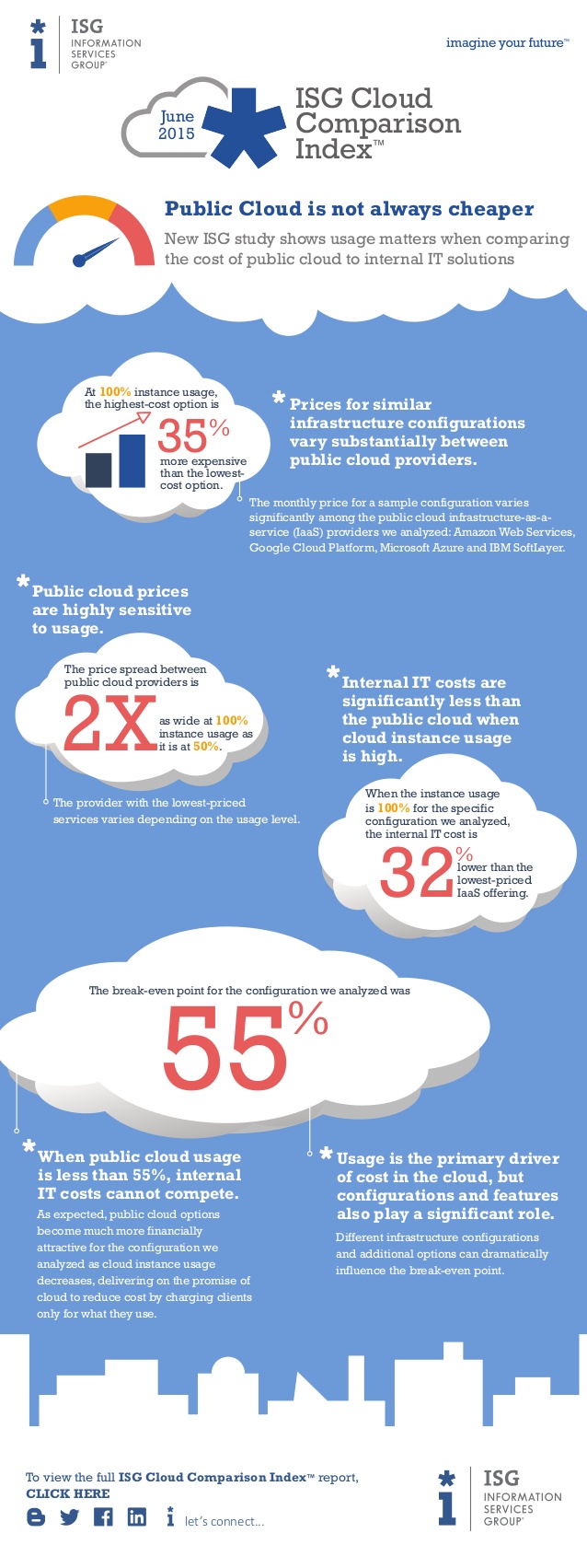

The inaugural report of the ISG Cloud Comparison Index™ shows the cost of running an application on an internal IT platform is cheaper than running the same program in the public cloud when compute instance usage is higher than 55 percent, but the pendulum swings in favor of public cloud when usage drops below that mark for certain configurations.

For specific infrastructure configurations, the study found the price of public cloud services varies significantly from one provider to the next, ranging from $811 per month to $1,096 per month at 100 percent usage levels. The cost of internal IT for the same configuration was $548 a month, 32 percent lower than the lowest public cloud price. Cloud instance usage is the percentage of time that a compute instance is running and accruing charges from the public cloud provider.

However, when the average usage level for public cloud falls to 55 percent, the cost of public cloud is at parity with the cost of internal IT. The cost advantage for public cloud increases significantly as the amount of time that instances can be released increases (that is, usage falls), the study finds.

“Pubic cloud is not always cheaper,” said Christopher Curtis, partner, ISG Emerging Technologies, and head of ISG’s Cloud Solutions practice. “It’s largely a factor of usage. High levels of public cloud usage can create scenarios in which internal IT is more cost effective; conversely, the cost advantage of internal IT disappears when public cloud usage is at lower levels, that is, applications can release more resources. The break-even point appears to be around 55 percent for the specific configuration we analyzed.”

Public cloud presents a compelling value proposition for enterprise buyers of IT outsourcing services, Curtis noted. “Think of it: pay for your infrastructure only when you need it, dramatically reduce capital expenditures and virtually eliminate the need for commitment, all while reducing the time to provision servers and storage. For most buyers, that sounds like a pretty good deal. However, buyers are discovering this value proposition applies only to selected applications and workloads, not to entire data centers,” Curtis said.

Other key findings of the inaugural ISG Cloud Comparison Index™ report include:

- Prices for identical infrastructure configurations vary substantially among public cloud providers. At 100 percent usage, the price differential is 35 percent from the highest cost option to the lowest, with the range narrowing gradually as average usage decreases.

- Public cloud prices are highly sensitive to usage. The price spread among public cloud providers is twice as wide at 100 percent usage as it is at 50 percent usage.

- Usage is the primary driver of cost in the cloud, but configurations and features also play a significant role. Different configurations and additional options, often specific to each cloud provider, can dramatically influence the break-even point between public cloud and internal IT costs.

“Enterprises should avoid viewing the public cloud only as a lever to reduce operating costs, as they do with traditional outsourcing solutions,” said Curtis. “Instead, they should view public cloud as a way to reduce or eliminate future capital expense by avoiding over-provisioning of internal IT resources to meet high levels of periodic demand. Public cloud creates significant cost-avoidance opportunities for volatile workloads. Applications with the most wide-ranging usage patterns are strong candidates for the cloud.”

“There are horses for courses in the usage of cloud services and what works for one company may not be the best for another.” Stated Craig Ashmole, Founding Partner of London-based IT Consulting CCServe. “To create viable business cases for workload migration, enterprises increasingly will need a deep understanding of the nuances of various pricing models, as well as how those models relate to specific workloads.”

To read the inaugural report of the ISG Cloud Comparison Index™ in its entirety, click here.

Having spent a majority of my career working with and supporting the Corporate CIO Function, I now seek to provide a forum whereby CIOs or IT Directors can learn from the experience of others to address burning Change or Transformation challenges.

Recent Comments